If you own or run a private business, chances are Private Equity firms are knocking on your door. But if you aren’t prepared for the unique language of private equity and M&A, conversations will leave you lost-in-translation, or worse, left in the dust by your PE-backed competitors.

To stay ahead of the game, every business owner, CEO, CFO, and President should know with these key terms for when acquirers come a-knockin:

1.) Turns / Multiple

“What multiple were they looking for?”

“Sounds like six to six-and-a-half…”

“I bet we can get them signed up if we give them another half-turn.”

Explained:

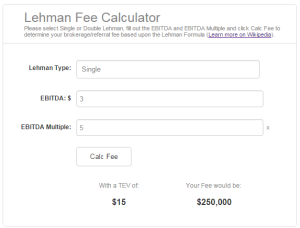

Turns or more commonly multiples of EBITDA are the standard in middle-market ($20-200m revenue businesses) for quickly comparing the cost of acquisitions to other transactions in the private market. For significantly sized businesses and outside of VC, tech and public markets, multiples are usually of EBITDA instead of revenue. In the middle-market, multiples generally range from three times (3x) to ten times (10x) EBITDA depending upon the specifics, with a typical range being 4-6.5x EBITDA. A business doing $5 million in EBITDA on $50m might sell for a 5x multiple (of EBITDA) leading to a $25m TEV (Total Enterprise Value). A turn would be going from a 4x EBITDA price to a 5x EBITDA price (or vice-versa). More simply, some might consider this as the number of years it might take for an investment to pay back (i.e. 4-5 years)

2.) Points

“We traditionally set aside a few points in a management pool to keep interests aligned.”

Explained:

Points are traditionally percentage points of equity, usually in a business. This is a conversation about reserving some percentage of equity ownership in the business for management to earn as an incentive for good performance of the business going forward.

3.) EBITDA (“Eeh-Bit-Dah”)

“How big is the business? How does your EBITDA look?”

Explained:

Earnings Before Interest, Tax, Depreciation & Amortization. This is THE key high-level and preliminary financial metric (in addition to Revenue) that is used in comparing acquisitions and investments to other transactions in the industry. A business doing $5 million in EBITDA on $50m might sell for a 5x EBITDA price (multiple) leading to a $25m TEV (Total Enterprise Value).

4.) Book

“Is there a book? When will the book be available?”

Explained:

Confidential Information Memorandum (CIM) or OM (Offering Memorandum) is also known in the industry as a “book” – a packet of materials for marketing a transaction with a business. Traditionally this is a multi-page document (say 20-50, but I have seen as many as 250+ pages) put together by a management team, investment banker, broker or M&A adviser that describes the operation of the business, their end markets, growth story, customers, leadership, plans for the future. Having a book that can be readily shared with potential acquirers (alongside an NDA of course) demonstrates a level of seriousness about a transaction. Many books today come in the form of detailed slidedecks.

5.) Concentration

“Are there any concentration issues?”

Explained:

Typically referring to industry and customer concentration. Diversification is the name of the game here. Risk is the enemy of private equity, and customer concentration has been shown to be one of the biggest non-starters for would-be acquirers. Most PE firms like to see companies with no customers that make up more than 10% or so of annual revenue. What happens if that 30% customer walks out the door?

6.) Roll

“How much is ownership looking to roll?”

Explained:

Rolling is a question of how much equity an existing owner is willing to keep on the table / reinvest / retain in the business going forward. Traditionally a Private Equity firm will want to take a majority equity position in a business, say around 80% to the existing owner’s 20% post-transaction. Technically speaking equity is usually rolled into a new entity as many transactions are asset sales (i.e. the owner is cashed out 100% from the existing business and purchases a 20% stake in the new entity, which acquires the assets of old entity).

7.) Platform / Add-On

“This business is too small as a platform, but we might look at it as an add-on for XYZ company.”

Explained:

Generally speaking Private Equity firms have growth-through-acquisition in mind when acquiring any business. Traditionally their initial investment in a given industry or niche is larger, and considered the nucleus or platform around which they can build. A given firm will usually raise a fund of committed capital and will traditionally acquire somewhere between 5 and 15 primary businesses within that found. Around each of those, they will often acquire many smaller synergistic businesses (“add-ons”) which allow the platform to grow accretively in addition to organically over the course of their funds ownership of the business.

8.) LP

“Our LP’s are hungry for direct investment, so we can definitely stomach larger acquisitions than our fund size might infer.”

Explained:

Limited Partners are the money behind the money. Each private equity fund (and most successful firms have many funds / vintages over their life) is a fixed-life vehicle for acquiring, building and selling companies with the objective of returning a profit to the investors. Limited Partner or LP’s are the institutions, high net worth individuals, government entities, foundations, etc that have committed an amount of capital to a fund with the understanding that they will receive a certain return on their investment. Often the promise from PE firms is 20-30% IRR and has a minimum preferred rate of return or Hurdle rate.

8.1(bonus term): Hurdle

“We won’t even be close to clearing the hurdle on that investment.”

Explained:

LP’s typical have a hurdle-rate or preferred return established with PE firms with whom they invest. A typical hurdle rate is 8%. The majority of the upside that PE firms earn is from the carried interest or earnings of a given fund, but most firm’s do not get any/much of that upside until they have at least cleared their hurdle rate (say 8%). While traditionally this applies fund-wide (vs deal-by-deal), this becomes an important number above which PE firms must ensure their companies/investments perform. While not common, some investors will structure that same hurdle or preferred return into their investment in a business to ensure they get the returns their investors desire.

9.) Independent Sponsor

“We have been operating as an independent sponsor for 10 years

and have closed 12 transactions in that time.”

Explained:

Independent Sponsors are also known as “Unfunded Sponsors” meaning they do not have an established, committed pool of capital from which then can draw. This means that after negotiating a transaction with a seller, they must pitch the deal to LP’s and other investors to get it funded. While this model is very successful for some, for others who are inexperienced or without the proper connections, sellers signed up under LOI (and exclusivity) can be dragging around for many months (and even years) with constantly prolonged closing as the buyer attempts to secure funding.

10.) LOI / IOI

“We are ready to move forward. When can we expect an LOI?”

Explained:

Letter of Intent (LOI) or Indication of Interest (IOI). Think of this as the term sheet, or offer on the table. This is fulfilling the old, “I don’t believe anything until I see it in writing.” Both are non-binding, though an Indication of Interest is usually more preliminary as in, “I believe your business is worth between $50m and $55m, and I am interested.” An LOI gets into more of the details about the value being brought to the table, what a transaction might look like, and when the buyer forsees closing upon a transaction (i.e. 60 days of diligence upon signing followed by 15 days to finalize a definitive agreement and close).

11.) Signed Up

“If we can get this signed up by next week, I don’t see

any reason why we can’t close by the end of June.”

Explained:

In addition to being time-sensitive (having an expiration date and time), LOI’s traditionally have a block for countersignature by the seller, asking the seller to agree to the preliminary terms of a transaction and to agree to work exclusively with said buyer for a certain period of time. When the seller / owner of a business returns a countersigned LOI, the deal is said to be “signed up” under exclusivity. While under exclusivity the seller agrees not to shop for a better or different deal, and to only work with this seller for the time being.

12.) Earnout

“What if we structure this thing? Are they open to an earnout?”

Explained:

An earnout is the process of paying out a seller over time post-closing, often dependent upon meeting pre-defined benchmarks. If the Total Enterprise Value (TEV) is $25m with $20m cash-at-close and $5m in the form of an earnout, then that $5m will be paid out over time from the proceeds of the business in years to come, not at closing.

13.) Leveraged Buyout

“We use a modest amount of leverage in all of our transactions.”

Explained:

It might seem like the old dirty word from the 80’s and 90’s, but majority-recapitalization LBO’s are still the standard operating procedures of Private Equity firms worldwide. Even if they don’t mention it up front, that PE firm in front of you will ABSOLUTELY be putting some debt on the business, and there is a damn good reason: it super-charges returns.

Consider this: you are going to acquire a majority stake in a business that all parties have agreed to value at $100m. You negotiate with the seller to acquire 80% and he will keep 20%, and he will continue to run the business day-to-day. So at this point you could write a check for $80m for 80% of the business, but instead you get a bank to pay for half of that ($40m) putting $40m in debt on the business, and you only have to cut a check for the other half ($40m). The business continues to grow, five years later the business has paid off all of the debt and is now worth $125m – nice work team! But more importantly, since the debt is all paid off, you truly own 80% of that $125m, or $100m. And how much cash did you have to invest to get to $100m? That’s right, $40m. That is a 2.5x cash-on-cash return giving you an IRR of 20%! So yes, that PE firm will be using debt and there is a damn good reason (so long as they don’t over-lever).

14.) Purchase Agreement

“I hope this is the final version of the DPA…”

“Don’t count on it.”

Explained:

Definitive Agreement (DA or DPA), Asset Purchase Agreement (APA) or Stock Purchase Agreement is a legal document that lays out all the details of a transaction. This document is very much final / definitive, and oftentimes transactions die here from hangups negotiating covenants and restrictions, exact legalese, details surrounding taxation once the deal becomes real, new discoveries during diligence, and frankly many petty personality and ego clashes.

15.) Retrading

“I swear to God, if they retrade on this, I’m walking away.”

Explained:

The process of retrading is, in my opinion, a horrible last minute attempt to change something in the purchase agreement often when you are down to the wire ready to close. This most often comes up as a “surprise” or “discovery” during diligence where new and previously unknown risks are used by the buyer to justify reducing the price. Some firms have a bad habit of throwing out big numbers with their IOI’s and LOI’s to get deals signed up, only to retrade multiple times in diligence to get to the value they actually wanted. This is not a common practice for most reputable PE firms, but something to watch out for none-the-less.

The world of Private Equity and M&A is full of success stories, successful exits, management buyouts, inter-generational transfers of ownership, growth, and long-term value, as well as letdowns and failed attempts. These key terms and pro-tips should help you avoid the potential pitfalls when pulling together a transaction. If you have other terms you would like explained (or believe would be helpful to others), just drop me a note in the comments below :).

Full disclosure, I spend the majority of my time connecting buyers and sellers as an M&A matchmaker, but am compensated by the buyers of the world. That said, I would be more than happy to learn about your transaction needs and see if one of the hundreds of buyers I work with might be a right fit for your business.

![]()

Disclaimer

The above materials (as well as other content on my blog) are for informational purposes only and not for the purpose of providing legal advice.